As 2025 winds down to a close, India’s tech startups leave behind a year of windfall gains from the market. They raked in approximately INR 33,573 Cr from 15 listings until November, surpassing nearly INR 29,070 Cr raised a year back.

The market was rather a damp squib in the early half of 2025, but it later shrugged off the sentiment and helped startups garner billions of dollars from the public markets. The startling rally drove the inescapable comparison with the dot-com era of the late 1990s, when many internet companies saw their stocks zoom despite sinking into losses.

And given the high valuations of some of the startups that have gone public, are we staring at a bubble waiting to burst?

“Certainly, not,” asserted Sanjiv Bhatia, the president and head of new economy and multinational coverage at Axis Bank. “It’s a healthy trend.”

In step with India’s transformation into the hottest listing destination, Axis Bank

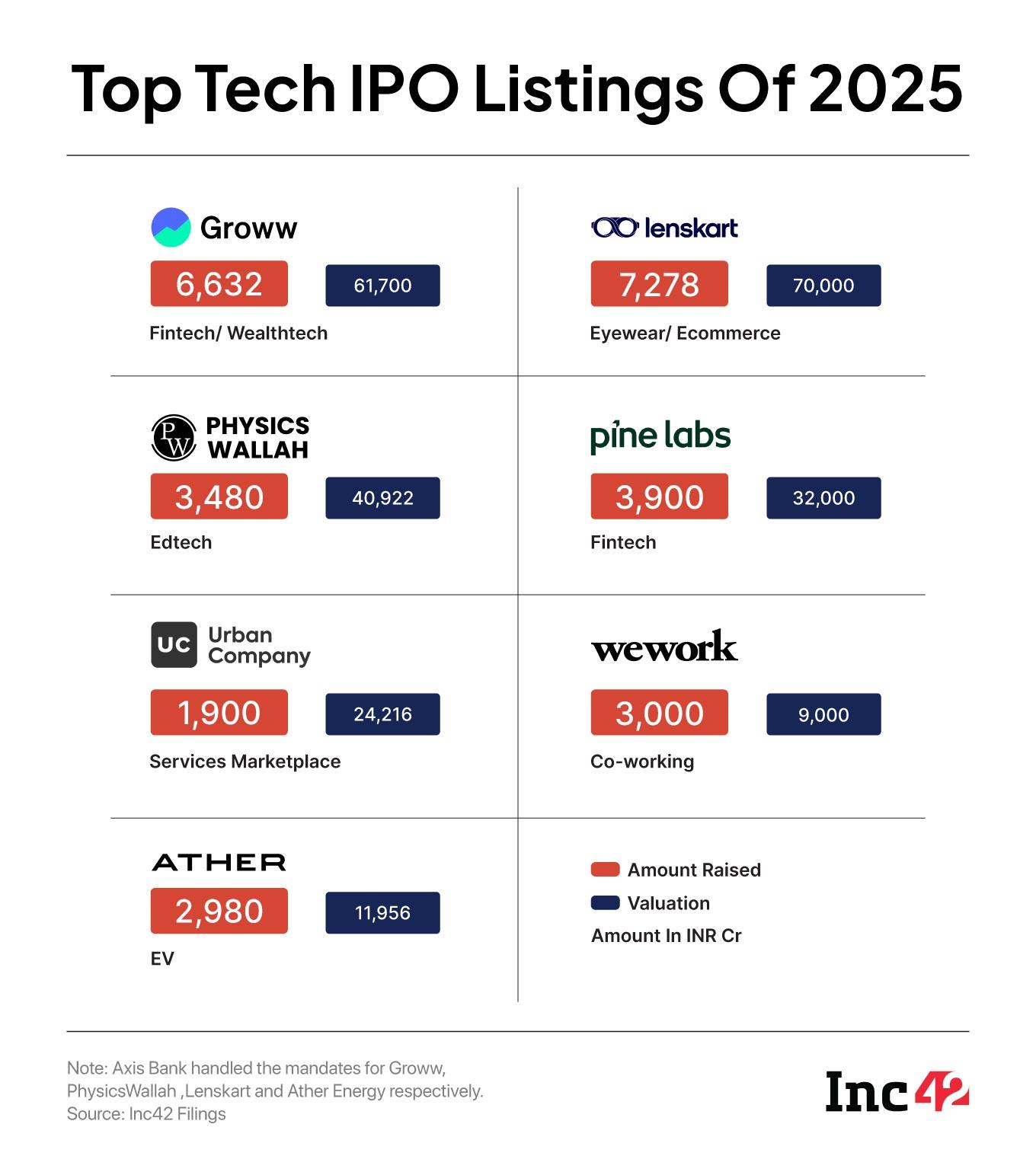

Its subsidiary Axis Capital has handled mandates for top tech listings this year that include Groww’s INR 6,632 Cr public issue, an INR 7,278 Cr Lenskart float and the INR 3,480 Cr PhysicsWallah IPO that together raised INR 17,840 Cr.

Standing against such a backdrop, Inc42 caught up with Bhatia to comprehend the evolving dynamics in India’s primary market.

He explained what are the forces behind the IPO rush, how the domestic savings engine has reshaped Indian markets, and why confidential filings may be the most important structural reform in years.

The Axis Bank executive who has been working closely with founders and VCs of some of the India’s top tech startups on their IPO journeys attributes the “hyped IPO trend among startups” to a combination of trends spanning from surging domestic inflows from SIPs and EPFOs, mutual funds hunting fresh deployment amid sky-high P/E ratios, and global private equity funds desperately seeking to exit late-stage funding drought.

Bhatia predicted a push from the investors and founders to raise money from the public market and this is likely to continue in 2026. “However there is no desperation to sell,” he adds.

Here are excerpts from the freewheeling interaction:

Excerpts

Inc42: India’s IPO market appears a lot hotter, especially for tech startups, compared to the subdued mood overseas. How do you see this?

Sanjiv Bhatia: There are a number of reasons. First, public markets are getting massive inflows from SIPs as formal employment is on the rise and there is subsequent growth in disposable incomes. Next, people are drifting from fixed deposits, gold, and real estate to equities for an upswing in general despite global headwinds.

We’re talking 40-50 Mn unique folios running SIPs, creating a wall of money deployed monthly. Mutual funds like SBI, HDFC, and Axis must park it somewhere. Our markets are expensive in terms of P/E ratios globally. So, they’re eyeing fresh IPOs over pricier listed stocks.

On the supply side, PE and VC funds, especially PEs with 5-10-year horizons, are also hitting exit deadlines.

Late-stage rounds have dried up over the last several years. Giants like SoftBank and Tiger Global are not actively investing in late-stage rounds due to global macro-economic headwinds.

At the same time, we have seen secondaries in the late-stage startup ecosystem going through a slump. So, for PE and VC exits, IPOs are becoming a go-to. Now, we consider this as healthy because, unlike public investors, the VCs have large risk appetites and they take huge bets on startups early on.

Good returns from IPOs return money to LPs from where they can raise fresh funds. Overall, it is a process of capital recycling through IPOs (even though mostly OFS), and raises fresh funds from LPs.

Inc42: We’ve seen bunching of IPOs towards the year end and startups holding off until the markets peaked. Do you see a strategy in it or does it signal overheating?

Sanjiv Bhatia: Nobody wants to sell cheap. If you’ve built an asset, you time the upswing.

margin: 0;

padding: 3px 8px !important;

font-size: 10px !important;

line-height: 20px !important;

border-radius: 4px !important;

font-weight: 400 !important;

font-style: normal;

font-family: noto sans, sans-serif;

color: #fff;

letter-spacing: 0 !important;

}

.code-block.code-block-55 .tagged {

margin: -4px 0 1px;

padding: 0;

line-height: normal;

}

@media only screen and (max-width: 767px){

.code-block.code-block-55 {

padding:20px 10px;

}

.code-block.code-block-55 .recomended-title {

font-size: 16px;

line-height: 20px;

margin-bottom: 10px;

}

.code-block.code-block-55 .card-content {

padding: 10px !important;

}

.code-block.code-block-55 {

border-radius: 12px;

padding-bottom: 0;

}

.large-4.medium-4.small-6.column {

padding: 3px;

}

.code-block.code-block-55 .card-wrapper.common-card figure img {

width: 100%;

min-height: 120px !important;

max-height: 120px !important;

object-fit: cover;

}

.code-block.code-block-55 .card-wrapper .taxonomy-wrap .post-category {

padding: 0px 5px !important;

font-size: 8px !important;

height: auto !important;

line-height:15px;

}

.single .code-block.code-block-55 .entry-title.recommended-block-head a {

font-size: 10px !important;

line-height: 12px !important;

}

.code-block.code-block-55 .card-wrapper.common-card .meta-wrapper .meta .author a, .card-wrapper.common-card .meta-wrapper span {

font-size: 8px;

}

.code-block.code-block-55 .row.recomended-slider {

overflow-x: auto;

flex-wrap: nowrap;

padding-bottom: 20px

}

.code-block.code-block-55 .type-post .card-wrapper .card-content .entry-title.recommended-block-head {

line-height: 14px !important;

margin: 5px 0 10px !important;

}

.code-block.code-block-55 .card-wrapper.common-card .meta-wrapper span {

font-size: 6px;

margin: 0;

}

.code-block.code-block-55 .large-4.medium-4.small-6.column {

max-width: 48%;

}

.code-block.code-block-55 .sponsor-tag-v2>span {

padding: 2px 5px !important;

font-size: 8px !important;

font-weight: 400;

border-radius: 4px;

font-weight: 400;

font-style: normal;

font-family: noto sans, sans-serif;

color: #fff;

letter-spacing: 0;

height: auto !important;

}

.code-block.code-block-55 .tagged {

margin: 0 0 -4px;

line-height: 22px;

padding: 0;

}

.code-block.code-block-55 a.sponsor-tag-v2 {

margin: 0;

}

}

))))>))>

Markets are rising on domestic flows, and SIPs, EPFO (now equity-heavy compared to the earlier debt-only days) and insurance companies have grown their AUMs. All this has prevented setbacks that could come from the sell off spree by Foreign Institutional Investors (FII).

Unlike past crashes, our base is solid. FIIs at the margin just amplify it. Not just startups – hospitals, main-street firms – are also lining up before bourses for premium pricing. That is primarily because all the financial services sector savings like I mentioned are being deployed in newer companies through IPOs.

This may seem like a crowded IPO market but with real capital backing it, I don’t think there is any need to be worried about the trend. There is no desperation to sell on the horizon as of now.

Inc42: Tech IPOs like Lenskart face the backlash for their lofty valuations while being in the loss or wobbling with just-made profits. As a banker pricing these, how do you justify it?

Sanjiv Bhatia: Profits will come—look at Lenskart: Glasses are essential with every other person needing those and hence a huge Total Adressable Market

The way these companies work is once they hit a scale in their topline, userbase , costs don’t rise linearly

Revenues accelerate by market share and margin expansion and we have seen it happening in the past. The rebound of Paytm is a perfect example. Everyone was putting them down but they staged a good turnaround.

Zomato flipped losses to path-to-profit. Sure, we cannot give the same benefit of doubt to Lenskart but we cannot ignore the way these new-age companies have shown discipline after their public market debut.

Inc42: But, do you believe Indian retail investors have that kind of risk appetite?

Sanjiv Bhatia: Let the retail investors park their money in MFs and other investment products The fund managers are smart guys and know their job.

The portfolio managers will shuffle their portfolio. I also believe that this market ( new-age companies IPO) is something that retail investors should not overtly invest into.

Portfolio managers are pros. They’ll cull underperformers – be it tech or non-tech companies. As far as equity exposure is concerned for a retail investor, it is possible via National Pension Scheme (NPS), mutual funds, insurance policies, and so on.

These institutional investors grill us deep in roadshows. There are 60-120-minute meetings where the institutional investors ask us about every aspect of the company going for a public debut. ‘Why this fintech? What’s the moat?’ We encounter such questions.

On the other hand SEBI has worked diligently when it comes to requirements of disclosures in DRHPs of the companies in terms of transparency.

Even for equity investors, one must understand that the returns aren’t just dividends – there is significant capital appreciation from Series A to IPO that mirrors growth. Having said that, there will be market corrections but overall we have seen a healthy upward trendline when it comes to capital gains from public markets.

Inc42: Axis handled over 60% of 2025 tech IPO mandates. How did you prepare the IPO-bound companies?

Sanjiv Bhatia: I must tell you that for every company listing, an IPO is not a button that you suddenly switch on. It is a 2-3-year-long marathon. It’s not like you decide today and you list tomorrow.

As bankers, the approach has essentially been sharing the learnings that we have earned from all the IPOs that we have done so far such as what does SEBI look for in a DRHP before approving it, and what mutual funds look to invest in?

We share our learnings with the founders. The metrics to gauge the financial health of the companies have changed from the conventional cash flow to other operating parameters like user base and market share. And based on these the founders choose their investment bankers for the public float.

It sort of is a handholding journey where the bankers sit down with CFOs of the companies, where we tell them how MIS reports are to be presented before the board to give an overview of the company, guide their secretarial teams on how to manage financial controls. And, when the company is IPO-ready, they file the DRHP.

I must tell you that not even a single DRHP filed by the companies we worked with has got rejected by SEBI. It is because of a lot of homework that goes before filing the DRHP. A lot of handholding goes into each one of them. That is what we do in our journey to prepare these companies for their IPOs. You get to see only the end result.

Inc42: Corporate governance lapses often make headlines in the startup landscape. How do you, as a banker, caution founders and investors?

Sanjiv Bhatia: As bankers, we maintain close tie-ups with investors (VCs) and founders alike. Even when we come in as lenders for several startups, there are VCs who will give us early heads-up on a company’s financial discipline or the overall culture.

One thing is for sure, even as a banker you have to be embedded in the ecosystem to know how these companies function. There are close founder networks in centres like Delhi and Bengaluru who speak to us and flag issues concerning the ecosystem.

But if you are a fringe player, you will not have that kind of intelligence inputs coming in.

Inc42: Bankers reportedly raked in INR 400-500 Cr in fees this IPO season. Are the tech startups paying bankers a premium over legacy firms?

Sanjiv Bhatia: There’s obviously a lot of hard work which goes into it and, as I said, none of our DRHPs have ever been rejected by SEBI.

We are also listed and when we report our numbers, Axis Capital is our subsidiary, so their numbers also get reported. So the numbers are there for everyone to see. But, you know, we are known for our quality work and that’s the way we’ll keep it. And of course, for quality, we should be able to charge a premium.

Inc42: What is your take on the confidential filings route adopted by startups since last year?

Sanjiv Bhatia: I think the biggest advantage for startups will be their ability to control the narrative. Once the DRHPs are in public domain, there can be ill-informed conclusions formed which can undo years of hard work that goes into making this business.

A lot of these startups going public are in the business for the last 15-20 years while there’s been a grind to take that startup from literally zero base to where they are right now.

Just one simple, viral, uninformed narrative can undo the entire hard work that the founder has put in. Hence, what the confidential route does is that the people who need to know, which are the public market investors, the fund managers and mutual funds, insurance companies and pension funds and all such details.

You can always have bilateral conversations with them, close room conversations with them where you can go into a lot of detail and these are the people who understand the space. So it still achieves the same purpose. So, I think it’s a good move by all means.

(Edited By Kumar Chatterjee)